2

Diwali Picks Report | November 2023

3

Diwali Picks Report | November 2023

Navigating Global Uncertainty: India on a Steady Ground

The Indian economy has sustained its growth momentum led by resilient urban

demand and positive macro-economic variables. India’s GDP is expected to grow at

6.3% in FY24 (highest globally) on the back of a resilient demand outlook, easing

inflationary pressures and moderating commodity prices. The momentum is

continuing with both Manufacturing and Services PMI in an expansionary zone as

demand conditions remain strong.

Early signs of capex revival are also visible led by increased capacity utilization,

revival in private capex, stabilization of the supply chain, and increased government

spending. Owing to steady economic growth, the trend in tax collections (16 straight

months of Rs1.4 Lakh Crs in GST collections) is likely to sustain, which should enable

the Government to be closer to its Fiscal Deficit target and maintain its focus on

Capex. Overall, the environment is also conducive for Private investments owing to

lower debt levels and healthy banking metrics.

India has made progress in keeping inflation at manageable levels through policy

measures and aided by lower commodity prices. Currently, Nifty PE is trading at 18.3x

1-Yr forward EPS, which is slightly lower than 5-Year average of 18.9x which is

favorable in our view. We are positive on Capital Goods, Construction, Consumer

Durables, FMCG, Healthcare, and IT. Elevated uncertainty arising from geopolitical

tensions, 2024 elections, and the volatility of crude oil prices constitute key short-

term risks.

Global interest rate hike cycle nears peak; growth expected to revert to trend

level

After nearly two years of high inflation, a sustained downtrend is in progress. The

downtrend was supported by aggressive monetary tightening and cooling of energy

prices. While commodity prices have come off from peaks levels; overall global

growth has remained surprisingly resilient led by strong consumption demand.

However, growth rates in developed countries are expected to revert back to the

long-term trend levels as Covid fiscal stimulus is rolled back and impact of rate

hikes and quantitative tightening plays out. This should curb commodity prices,

thereby supporting Indian companies' profit margins.

India is in a strong position amidst a relatively uncertain global scenario

Overall economic growth is expected to sustain its momentum led by easing

inflationary pressures and resilient demand outlook. The normalization in global

growth is likely to keep oil prices in check, aiding the overall external situation.

Moreover, India is in a comfortable position with manageable CAD (-1.1% in 1QFY24

of GDP) and sufficient forex reserves (US $586 Bn) which should aid in absorbing any

near-term shocks. Further, strong tax collections and rising capacity utilization

levels are expected to drive overall investments. Also, strong corporate balance

sheets and healthy banking metrics should also support private capex revival.

DIIs & Retail have emerged as dominant players; FII flows turned positive

We note that FII’s have turned net buyers in FY24 YTD. After net outflows of ~Rs4.7L

Cr in FY22 & FY23; we have seen an FIIs inflow of Rs0.29L Cr in FY24 (YTD’Sep’23).

However, despite FIIs flows being volatile, the Indian markets have been buoyant

driven by strong SIP flows (+23% CAGR over the last 7 years) and domestic buying.

Additionally, the emergence of direct retail participants has been instrumental in

lowering overall dependence on FIIs.

Top Picks

Company

CMP (₹)

TP (₹)

Capital Goods

AIA Engineering

3,513

4,230

Kirloskar Oil

543

650

Polycab India

4,921

6,350

Ramkrishna Forg.

641

780

Wendt India

12,320

15,480

Construction

H.G. Infra Engg.

894

1,190

Consumer Durables

Blue Star

878

1,130

Cera Sanitary.

8,481

10,740

Safari Inds.

4,140

5,330

Financial Services

CRISIL

4,105

4,850

FMCG

Godfrey Phillips

2,261

2,700

Nestle India

24,239

28,700

Healthcare

Narayana Hrudaya

996

1,260

Information Technology

LTIMindtree

5,061

6,370

Persistent sys

6,162

7,700

Source: Company, Angel Research

Closing price as on 31Oct2023

4

Diwali Picks Report | November 2023

Global interest rate hike cycle nears peak; growth expected to revert to trend

level

After nearly two years of high inflation, a sustained inflation downtrend is now

underway. The downtrend was supported by aggressive monetary tightening and

reversal of causal factors such as supply-side dislocations induced during Covid-19

and surge in energy prices. While commodity prices have come off from peaks

levels; overall global growth has remained surprisingly resilient led by strong

consumption demand. However, growth rates in developed countries are expected

to revert back to the long-term trend levels as Covid fiscal stimulus is rolled back

and impact of rate hikes and quantitative tightening plays out. This should curb

commodity prices, thereby supporting Indian companies' profit margins.

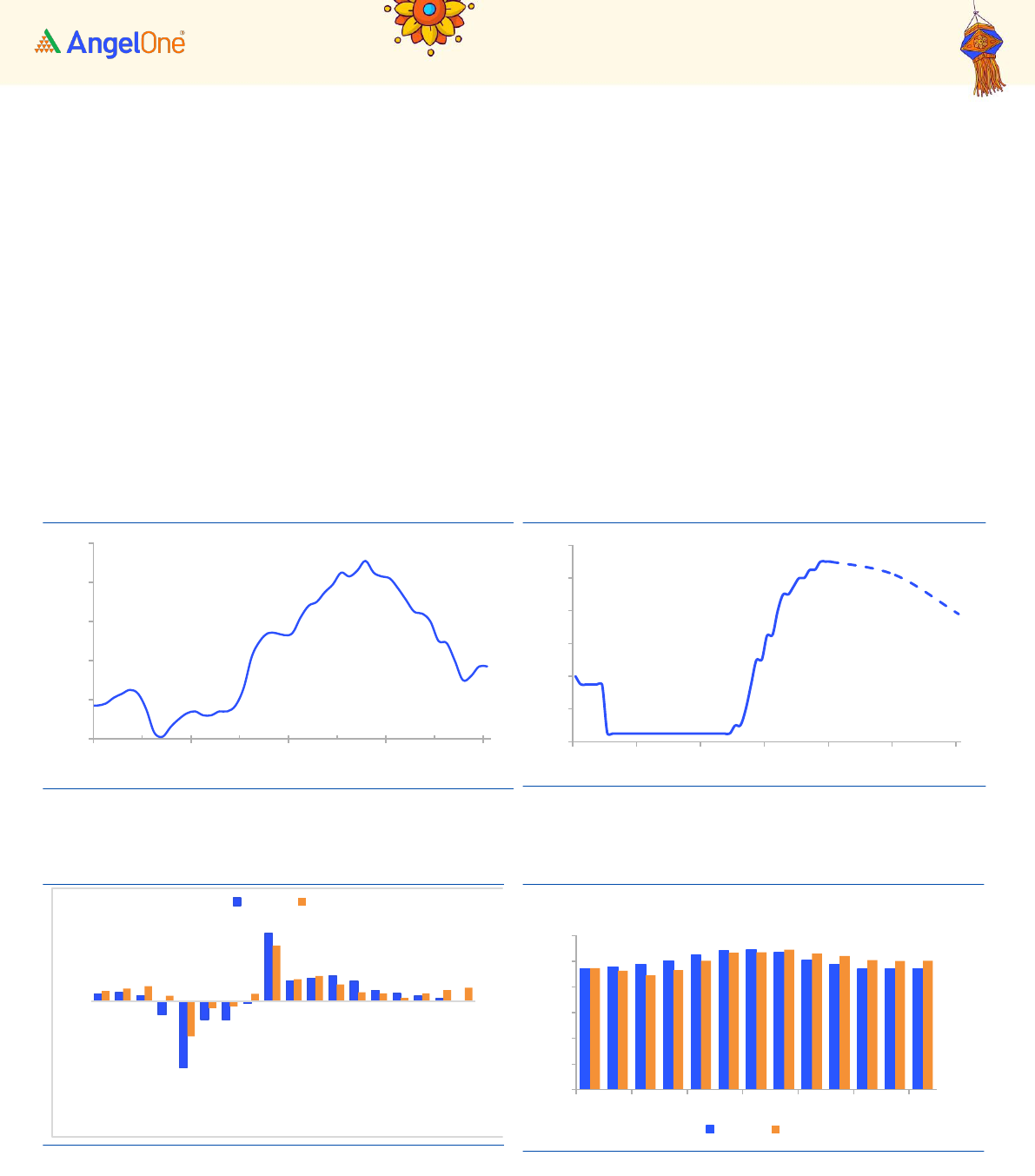

Exhibit 1: US inflation (CPI YoY%) on a downtrend

Source: Bloomberg, Angel Research

Exhibit 2: Fed rate hike cycle is expected to peak out

Source: Bloomberg, Angel Research

Exhibit 3: Real GDP growth moderating towards trend levels

Source: Bloomberg, Angel Research

Exhibit 4: Composite PMIs are closer to contraction zone

Source: Bloomberg, Angel Research

India in a strong position amidst a relatively uncertain global scenario

India continued to be the world’s fastest growing economy amongst the major

countries with real GDP growth of 7% and 7.8% in FY23 and Q1 FY24 respectively. A

sustained recovery in discretionary spending, restoration of consumer confidence,

high festival season spending after two consecutive years of COVID-19 induced

isolation and the government’s thrust on capex provided impetus to the growth

momentum. The index of supply chain pressure for India remains below its

2.3

0.1

9.1

3.7

0

2

4

6

8

10

Sep/19

Sep/20

Sep/21

Sep/22

Sep/23

(%)

1.75

0.25

0.5

5.5

5.1

3.9

0

1

2

3

4

5

6

Sep/19

Sep/20

Sep/21

Sep/22

Sep/23

Sep/24

Sep/25

(%)

(14.2)

14.5

5.4

0.5

(7.5)

11.9

3.6

2.9

-20

-15

-10

-5

0

5

10

15

20

Q1 FY20

Q4 FY20

Q4 FY21

Q4 FY22

Q2 FY24

Europe

USA

47.1

54.4

47.2

47.3

53.5

50.2

0

10

20

30

40

50

60

Oct/22

Dec/22

Feb/23

Apr/23

Jun/23

Aug/23

Oct/23

US Europe Composite PMI

Europe

USA

5

Diwali Picks Report | November 2023

historical average, supporting growth impulses. Growth in GDP figures is expected

to be sustained amid positive business sentiments backed by robust demand

conditions.

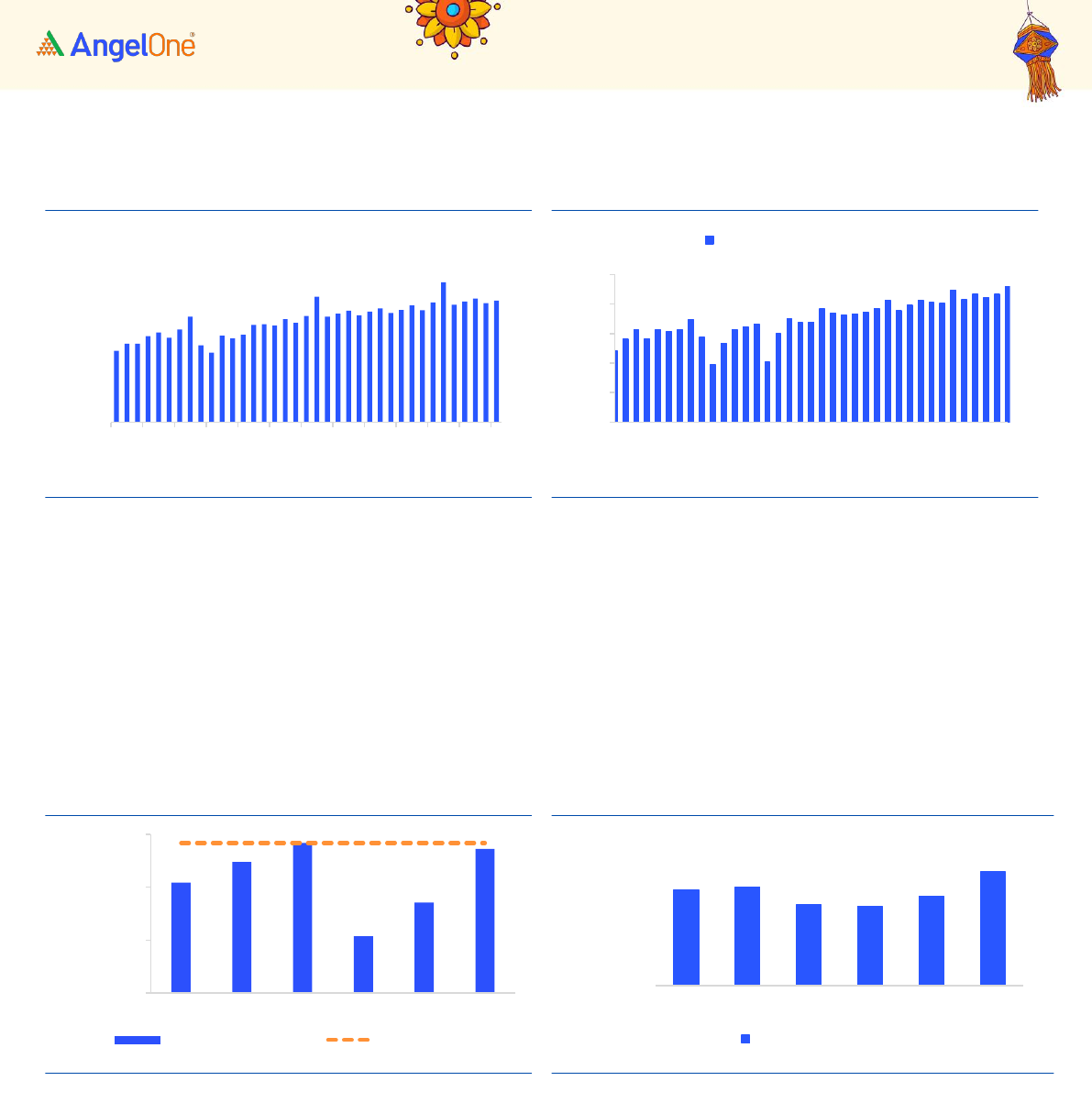

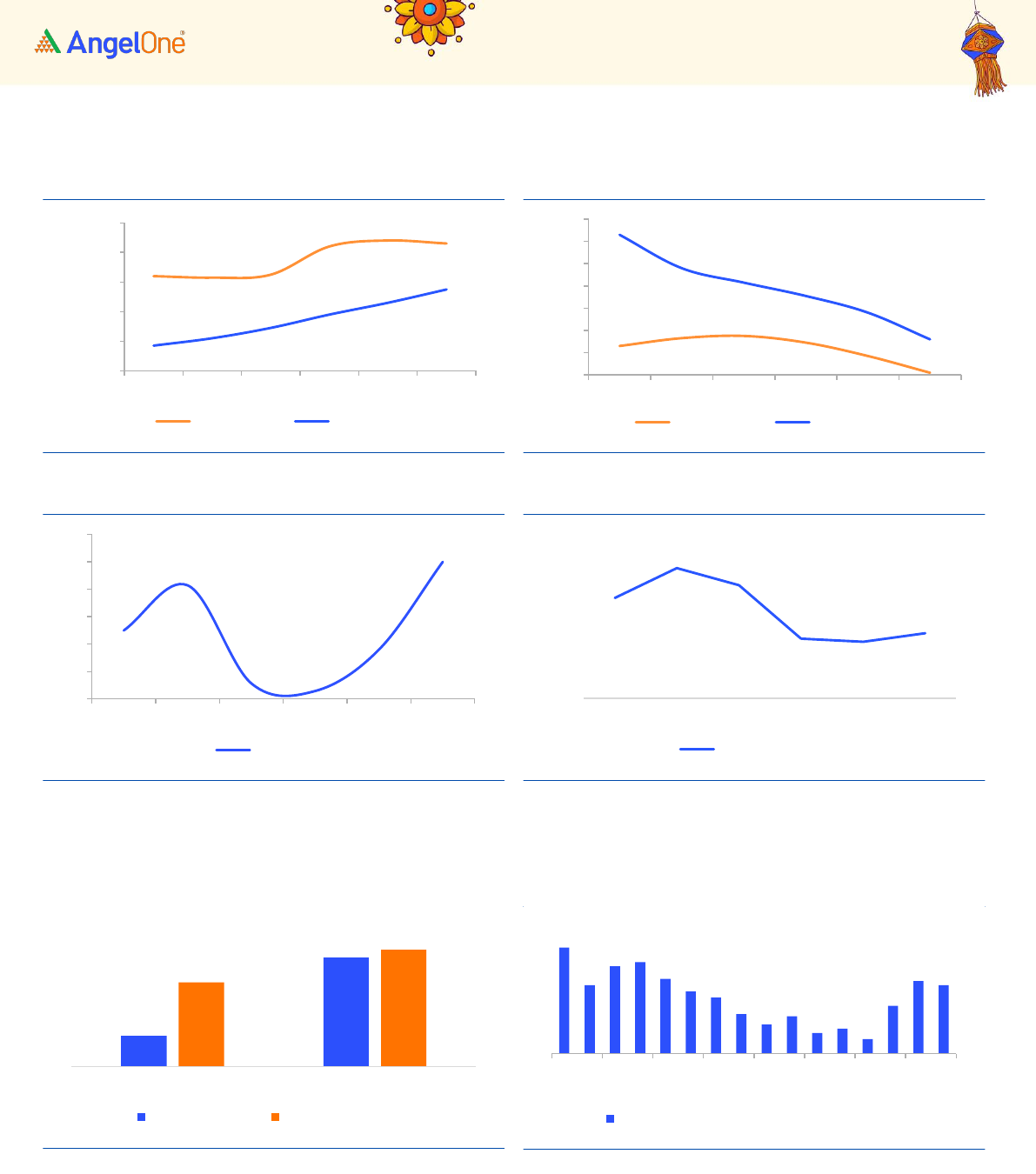

Exhibit 5: Stable growth rates amid inflationary pressures

Source: Bloomberg, Angel Research

Exhibit 6: India is expected to outperform all major

economies

Source: Bloomberg, Angel Research

A positive trend in most of the high-frequency indicators provides reassurance on

the growth momentum. The PMI for the manufacturing sector has remained in the

expansionary zone for almost three years now and the output prospects are

assessed to be strong. Services recorded their sharpest increase in over 13 years,

led by robust demand and new business gains.

Exhibit 7: Manufacturing has maintained growth

Source: Bloomberg, Angel Research

Exhibit 8: Services momentum strengthening

Source: Bloomberg, Angel Research

GST collections are strong as they are recording steady growth with average

monthly collections during Apr-Aug’23 stood at INR 1.66 Lakh crore, up from INR 1.49

lakh Crore same period last year. This will further encourage the government to

maintain its focus on capex. E-way bill volumes also registered a healthy expansion,

indicating robust trade activity.

-23.8

20.1

13.1

6.2

4.5

6.1

7.8

-30.0

-15.0

0.0

15.0

30.0

Q1FY19

Q1FY20

Q1FY21

Q1FY22

Q1FY23

Q1FY24

(%)

India Real GDP YoY

7.4

3.5

6.2

6.9

4.9

4.9

5.0

3.0

5.1

-0.9

1.5

2.5

2.4

1.9

1.8

2.2

0.6

0.6

-2.0

0.0

2.0

4.0

6.0

8.0

CY15-CY18

CY19-CY22

CY23-24E

(CAGR,%)

Real GDP average growth

India

China

Indonesia

Brazil

US

UK

57.5

20.0

30.0

40.0

50.0

60.0

Indian Manufacturing PMI

60.1

20.0

30.0

40.0

50.0

60.0

Indian Service PMI

6

Diwali Picks Report | November 2023

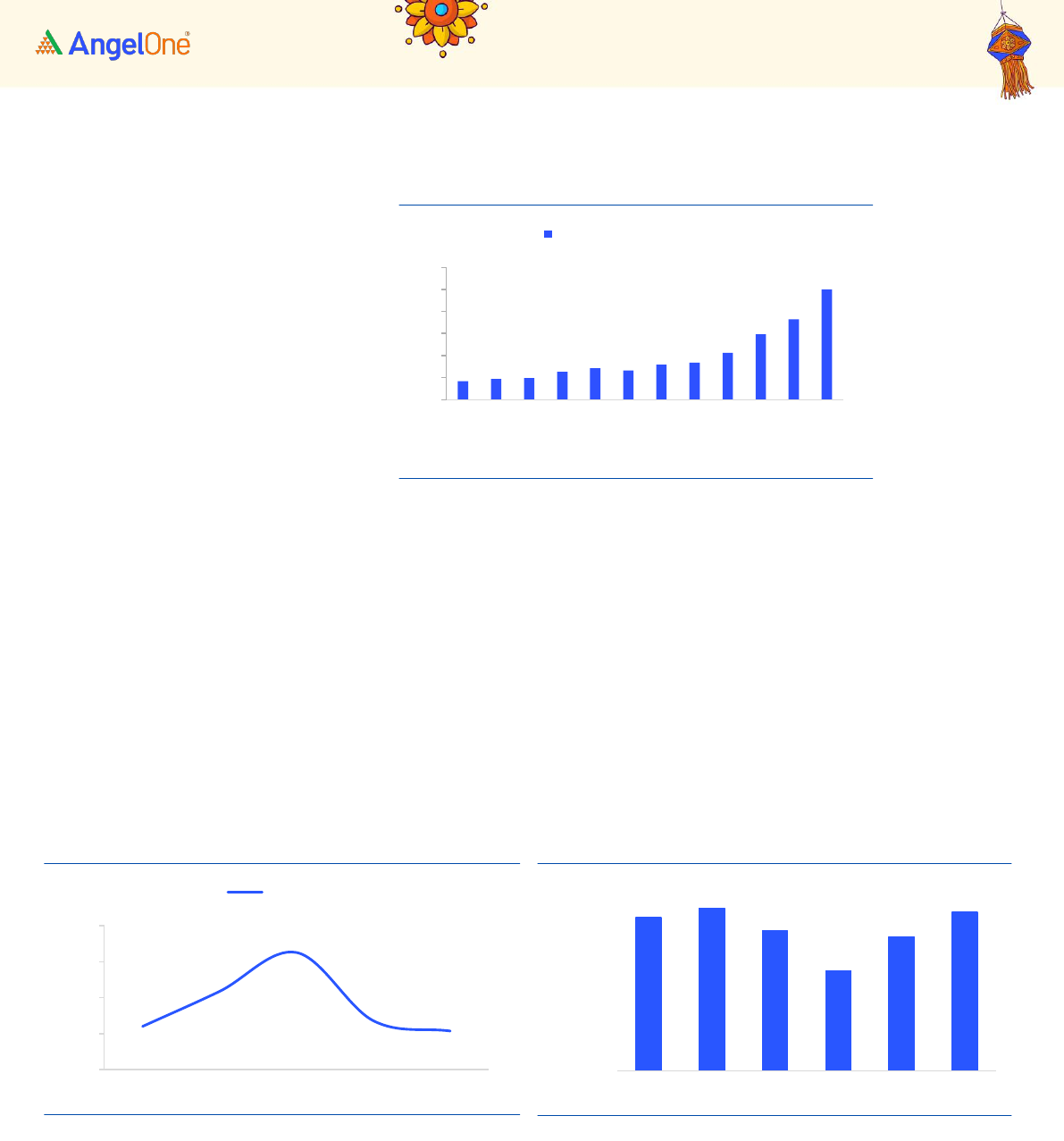

Exhibit 9: GST collection to sustain on broader growth

Source: GSTN, Angel Research

Exhibit 10: E-way data points to better freight availability

Source: GSTN, Angel Research

India’s aggregate demand indicates positive momentum. Among urban demand

indicators, passenger vehicle sales have reached all-time high levels in F23, credit

card spending and UPI transactions are increasing at a healthy rate and domestic

aviation traffic showing smart recovery and nearing pre covid levels. In FY23, the

UPI platform processed a total of 8,375 crore of transactions aggregating to Rs. 139

Lakh crore, compared with 4,597 crore of transactions worth Rs. 84 Lakh crore in

FY22. Further, total credit card spending in FY23 surged by 47.3%, surpassing the

30.1% rise in transaction volume. This suggests a notable increase in spending per

transaction.

Exhibit 11: Domestic aviation traffic nearing previous high

Source: DGCA, Angel Research

Exhibit 12: Passenger vehicle to corroborate urban demand

Source: Angel Research

162.71

-

50

100

150

200

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Sep-22

Dec-22

Mar-23

Jun-23

Sep-23

GST Collection Rs. '000 Cr

91.76

-

20

40

60

80

100

Aug-20

Dec-20

Apr-21

Aug-21

Dec-21

Apr-22

Aug-22

Dec-22

Apr-23

Aug-23

Eway Bill generations (mns)

104

124

142

54

85

136

-

50

100

150

FY18

FY19

FY20

FY21

FY22

FY23

(No of Pax in mn)

Domestic Air Traffic

Pre covid level

32.9

33.8

27.7

27.1

30.7

38.9

-

10.0

20.0

30.0

40.0

50.0

FY18

FY19

FY20

FY21

FY22

FY23

Nos in Lacs

Passenger Vehicle

7

Diwali Picks Report | November 2023

Exhibit 13: UPI Transactions on consistent uptrend

Source: DGCA, Angel Research

Exhibit 14: Credit card spends on rise

Source: Angel Research

India‘s capex cycle to pick pace

Investments and consumption are the major drivers of India’s growth story. After

experiencing a slowdown in investment since 2013-14, early signs of revival of the

capex cycle are visible since 2021-22. Investment activity gained steam on the back

of government capital expenditure, rising business optimism, and a revival in

private capex in certain key sectors. Traction in construction activity is likely to be

sustained as reflected in steady expansion in its proximate indicators: Steel

consumption and cement production.

A few of the favorable government policies that are likely to promote capex and

infrastructure development in India are:

1. Production linked Incentive Scheme worth Rs. 2 Lac Cr across 14 sectors to

promote domestic manufacturing and exports

2. National Infrastructure Pipeline with a projected infrastructure of around

Rs. 111 Lac Cr during FY20-25 to provide high-quality infrastructure across

the country

3. National Monetization Pipeline to monetize Rs. 6 Lac Cr worth of

government assets from FY22-25 to fund new infrastructure projects

4. PM Gati Shakti to provide multi nodal connectivity infrastructure to various

economic zones

5. In order to boost exports, India has signed 13 Regional Trade Agreements

(RTAs) /Free Trade Agreements (FTAs) with various countries/regions such

as Singapore, Malaysia, Thailand, Japan, Sri Lanka, Mauritius, UAE,

Australia etc. and is also in advance talks with the UK

Further in line with various policies, the government in the Union Budget 2023-24,

budgeted capital expenditure increased by ~37% from Rs. 7.3 Lac Cr in FY23 to Rs.

10 Lac Cr in FY24 (60% is expected to be utilized by Nov’23).

-

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

18.0

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Sep-22

Dec-22

Mar-23

Jun-23

Sep-23

UPI Transactions in Value (Rs.Lakh Cr)

4.6

6.0

7.3

6.3

9.7

14.3

FY18

FY19

FY20

FY21

FY22

FY23

Credit Card Spends (Rs. Lac Crores)

8

Diwali Picks Report | November 2023

Exhibit 15: Govt Capital expenditure increased by ~37%

Source: Budget Documents, Angel Research

This is resulting in crowding effect which is encouraging private capex. Corporate

India finds itself in a favorable position for investment, propelled by high capacity

utilization, robust balance sheets, clear demand visibility, and optimistic

expectations for earnings growth. Capacity utilization in the manufacturing sector

at 76.3% in Q4FY23 which is above the average of 70.6% (6 Years). Additionally,

corporate India has significantly improved its debt-to-equity ratio reducing from

1.6x in FY21 to 0.5x in FY23, as a result, they now possess a stronger balance sheet,

enabling them to embark on capital expenditure. Given the combination of higher

capacity utilization, reduced leverage on their balance sheets, strong demand

visibility, and government support it is imminent that corporate India will pursue

capital expenditures.

Exhibit 16: Corporate India Debt to Equity

Source: Budget Documents, Angel Research

Exhibit 17: Manufacturing Capacity Utilization

Source: RBI, Angel Research

SCB’s credit growth has been accelerating since early 2022, led by both public and

private sector banks recording a 15.0% y-o-y growth in FY23. The strength of loan

demand was reflected in the rising volume of new loans extended by SCBs.

Simultaneously, the financial health of banks improved with better asset quality and

capital ratios, thus assuring adequate liquidity to meet the credit needs of the

growing economy.

1.7

7.3

10.0

0

2

4

6

8

10

12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

FY23RE

FY24BE

Capital Expenditure (in Lk Cr)

0.6

1.1

1.6

0.7

0.5

-

0.5

1.0

1.5

2.0

FY19

FY20

FY21

FY22

FY23

Debt/Equity

73

75

70

62

69

74

40

45

50

55

60

65

70

75

80

FY18

FY19

FY20

FY21

FY22

FY23

(%)

9

Diwali Picks Report | November 2023

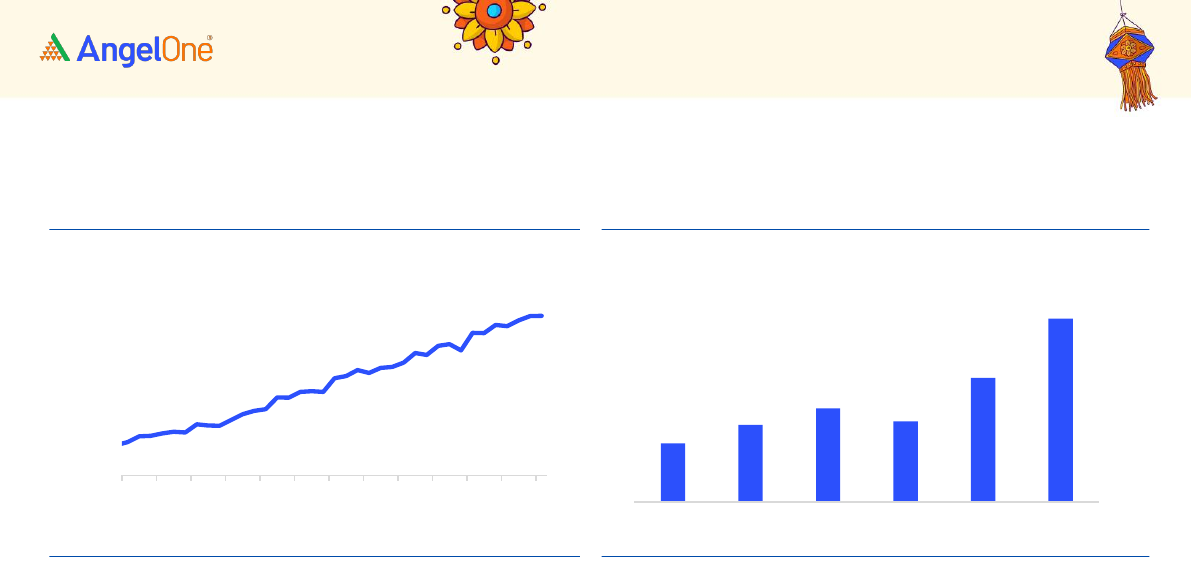

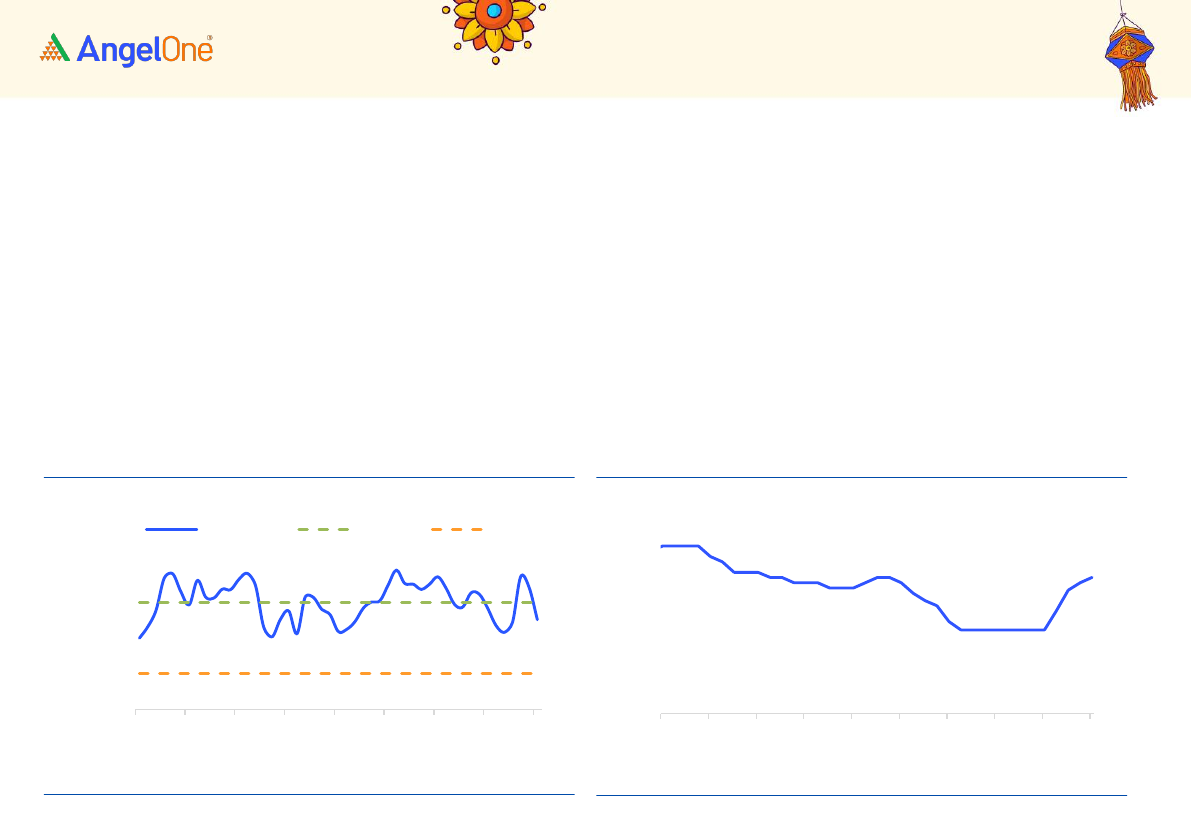

Exhibit 18: Improvement in Capital Adequacy Ratio

Source: RBI, Angel Research

Exhibit 19: Bank’s asset quality has been improving

Source: RBI, Angel Research

Exhibit 20: Increase in credit growth

Source: RBI, Capitaline, Angel Research

Exhibit 21: CD ratio shows headroom for lending

Source: RBI, Angel Research

Considering the robust growth outlook, Nifty and Bank Nifty earnings are

expected to grow by 15.8% & 17.0% from FY23-FY25E respectively.

Exhibit 22: Nifty & Bank Nifty robust growth expectations

Source: RBI, Angel Research

Exhibit 23: Corporate profit to GDP stable with room to rise

Source: RBI, Angel Research

16.4

16.3

16.5

18.4

18.8

18.6

11.7

12.2

12.9

13.8

14.6

15.5

10

12

14

16

18

20

FY18

FY19

FY20

FY21

FY22

FY23

(%)

Private banks

PSU Banks

4.6

5.3

5.5

4.9

3.7

2.2

14.6

11.6

10.3

9.1

7.6

5.2

2

4

6

8

10

12

14

16

FY18

FY19

FY20

FY21

FY22

FY23

Gross NPA (%)

Private Banks

PSU Banks

10.0%

13.3%

6.1%

5.6%

8.6%

15.0%

5%

7%

9%

11%

13%

15%

17%

FY18

FY19

FY20

FY21

FY22

FY23

Credit Growth

75.5%

77.7%

72.4%

72.9%

68%

70%

72%

74%

76%

78%

80%

FY18

FY19

FY20

FY21

FY22

FY23

Credit to Deposit %

4.4%

15.8%

12.2%

17.0%

FY13-23

FY23-25E

Nifty EPS (CAGR)

Bank Nifty EPS (CAGR)

6.1

5.4

4.0

2.8

1.7

3.3

4.5

4.3

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

FY23

Corporate profits of listed companies (% of GDP)

10

Diwali Picks Report | November 2023

Inflation broadly at manageable levels

On the inflationary pressures, India has made significant progress towards

controlling inflation. While monetary transmission is still underway, India’s headline

inflation is now within an upper target range of 6%, and the MPC remains committed

to align India’s inflation to the 4% target. Elevated uncertainty arising from

geopolitical tensions and volatility of crude oil prices constitutes an upside risk to

inflation target.

Exhibit 24: India Inflation is now within RBI’s target range

Source: Bloomberg, Angel Research

Exhibit 25: Moderation in rate hikes by RBI

Source: Bloomberg, Angel Research

DIIs & Retail have emerged as dominant players; FII outflows turned positive

The Indian markets have demonstrated remarkable resilience in the face of volatile

FII flows, unlike previous instances of FII selling. This resilience is attributed to the

robustness of domestic institutions (including Mutual Funds) and a steadily

expanding base of retail investors. We note that FIIs have turned net buyers in FY24

YTD. After net outflows of ~Rs4.7L Cr in FY22 & FY23; we have seen an FIIs inflow of

Rs.0.29L Cr in FY24 (YTD’Sep’23). However, despite FIIs flows being volatile, the

Indian markets have been buoyant driven by strong SIP flows (+23% CAGR over the

last 7 years) and domestic buying. Additionally, the emergence of direct retail

participants has been instrumental in lowering overall dependence on FIIs.

7.6

7.6

4.1

4.2

6.3

4.5

7.8

7.4

6.4

4.3

7.4

5.0

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

Sep/19

Mar/20

Sep/20

Mar/21

Sep/21

Mar/22

Sep/22

Mar/23

Sep/23

(%)

India CPI % YoY

Upper Band

Lower Band

8.0

7.5

6.8

6.5

6.0

6.5

4.0

4.0

6.5

0

1

2

3

4

5

6

7

8

9

10

Mar/14

Mar/15

Mar/16

Mar/17

Mar/18

Mar/19

Mar/20

Mar/21

Mar/22

Mar/23

%

11

Diwali Picks Report | November 2023

Exhibit 26: MFs supported by strong SIP flows

Source: Bloomberg, Angel Research

Exhibit 27: FII flows have turned positive

Source: Bloomberg, Angel Research. FY24 is till Sep 2023

Nifty PE trading near its 5-year average

Currently, the Nifty PE is trading at 18.3x its 1-Yr forward EPS, which is slightly lower

than 5-Year average of 18.9x. We believe that valuations are reasonable given the

current inflationary environment which is leading to aggressive monetary

tightening. We are positive on Capital Goods, Construction, Consumer Durables,

FMCG, Healthcare and IT. Elevated uncertainty arising from geopolitical tensions,

2024 elections and the volatility of crude oil prices constitute key short-term risks.

Exhibit 28: Nifty 1 Year Forward PE is trading at reasonable levels

Source: Bloomberg, Angel Research

8,819

12,140

16,042

0

5,000

10,000

15,000

20,000

Sep-20

Sep-21

Sep-22

Sep-23

SIP Inflow (Rs. Cr)

200,563

(275,348)

(198,639)

29,039

FY21

FY22

FY23

FYTD24

FII Inflow / (Outlflow) in Rs. Cr

18.3

18.9

10.0

12.0

14.0

16.0

18.0

20.0

22.0

24.0

Oct/13

Oct/14

Oct/15

Oct/16

Oct/17

Oct/18

Oct/19

Oct/20

Oct/21

Oct/22

Oct/23

12

Diwali Picks Report | November 2023

Diwali Picks

13

Diwali Picks Report | November 2023

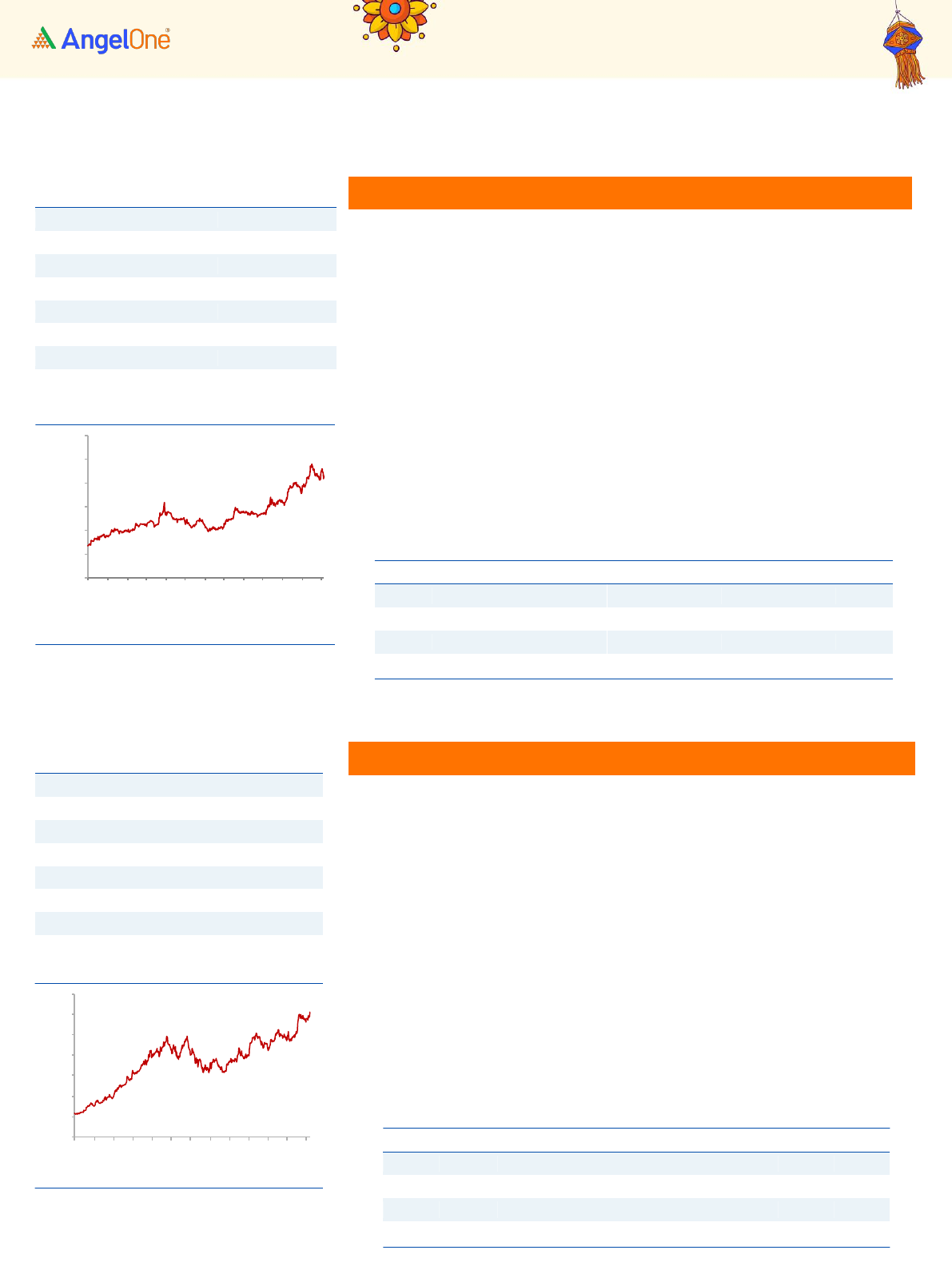

Polycab India

Polycab India Ltd is one of the leading manufacturers of wires and cables in

India. With a robust brand presence, the company boasts an extensive array

of products for retail and industrial use. Polycab is strategically broadening

its footprint in the rapidly expanding FMEG segment, dealing in products like

Fans, Switches, Switchgear, LED Lights and Luminaries, Solar Inverters and

Pumps.

In Q2FY24, revenue rose by 26.5% on a YoY basis to Rs 4,218 Crores and net

profit rose by 58.9% on a YoY basis to Rs 430 Crores. Strong growth was

driven by healthy volume growth in the Cables & Wires segment.

With a robust brand presence and surging demand in the wire and cable

industry, the company is expected to benefit from the same. Anticipated

strong traction in the domestic Cables & Wires segment, driven by

government expenditure and real estate off-take, reinforces this growth

outlook. In the FMEG segment, a focus on premiumization and margin

improvement is likely to support growth.

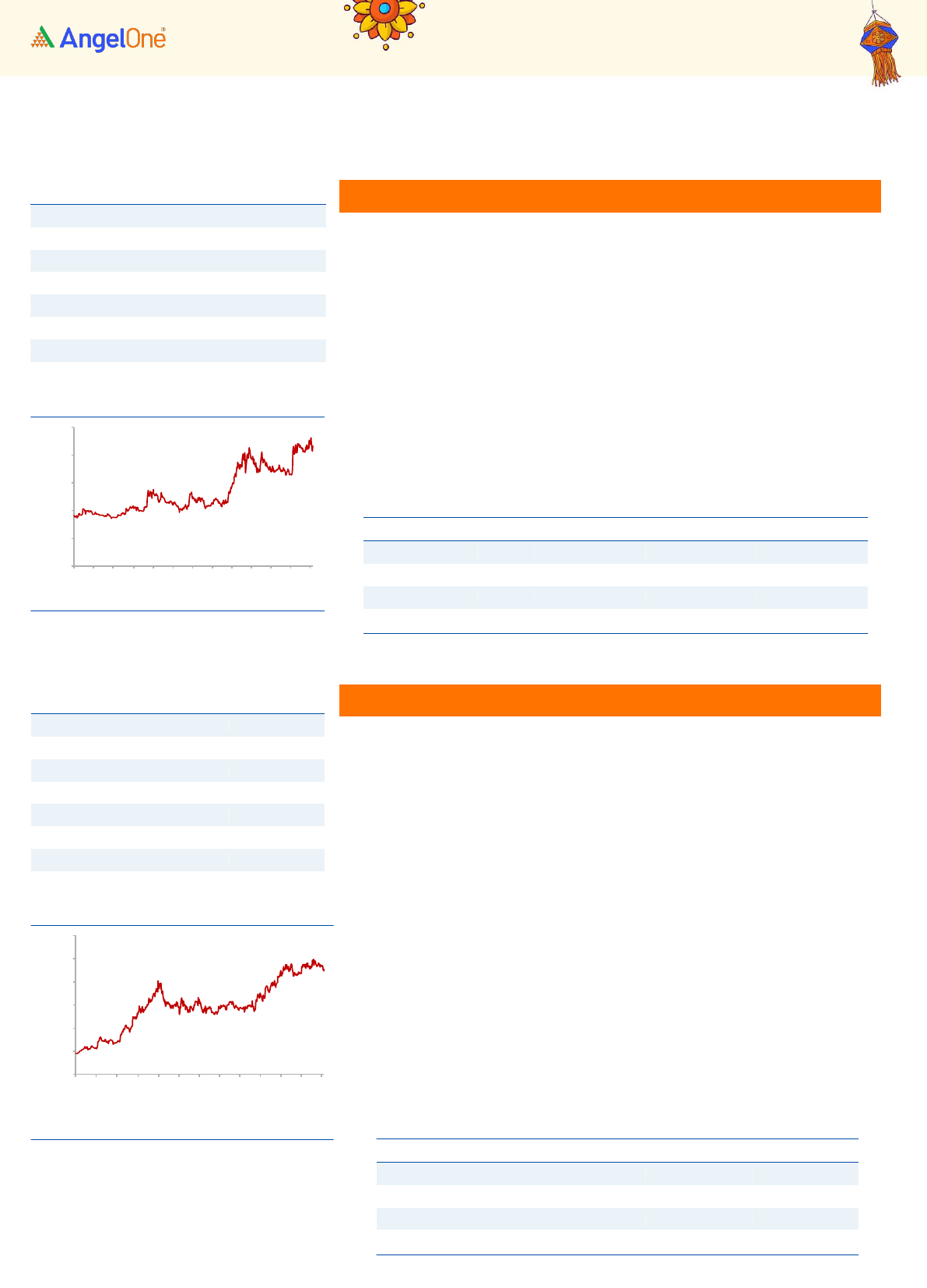

Narayana Hrudayalaya

Narayana Hrudayalaya Ltd (NH) is engaged in providing healthcare services. It

has a network of 45 healthcare facilities including multispecialty, and super

specialty hospitals spread across India.

In Q1 FY24, revenue rose by 19.3% on a YoY basis to Rs 1,233 Crores and net

profit rose by 65.8% on a YoY basis to Rs 184 Crores. Growth in profitability

supported by improvement in margins

NH is a well-established healthcare service provider that has shown double

digit topline growth in the last 5-10 years along with margin improvement. As

the newer hospitals mature, there is scope for further margin improvement.

The company plans to do a capex of Rs. 1100 Cr (~30% of FY23 Gross Block)

and plans to focus on its core and high-performing regions such as

Bangalore, Kolkata, and Cayman, which is likely to enhance growth visibility.

More focus will be on the fastest payback capacity like faster MRIs, and

adding new beds. All of this is likely to support future growth

Stock Info

CMP

4,921

TP

6350

Upside

29%

Sector

Capital Goods

Market Cap (`cr)

74,720

Beta

0.9

52 Week High / Low

5493/2500

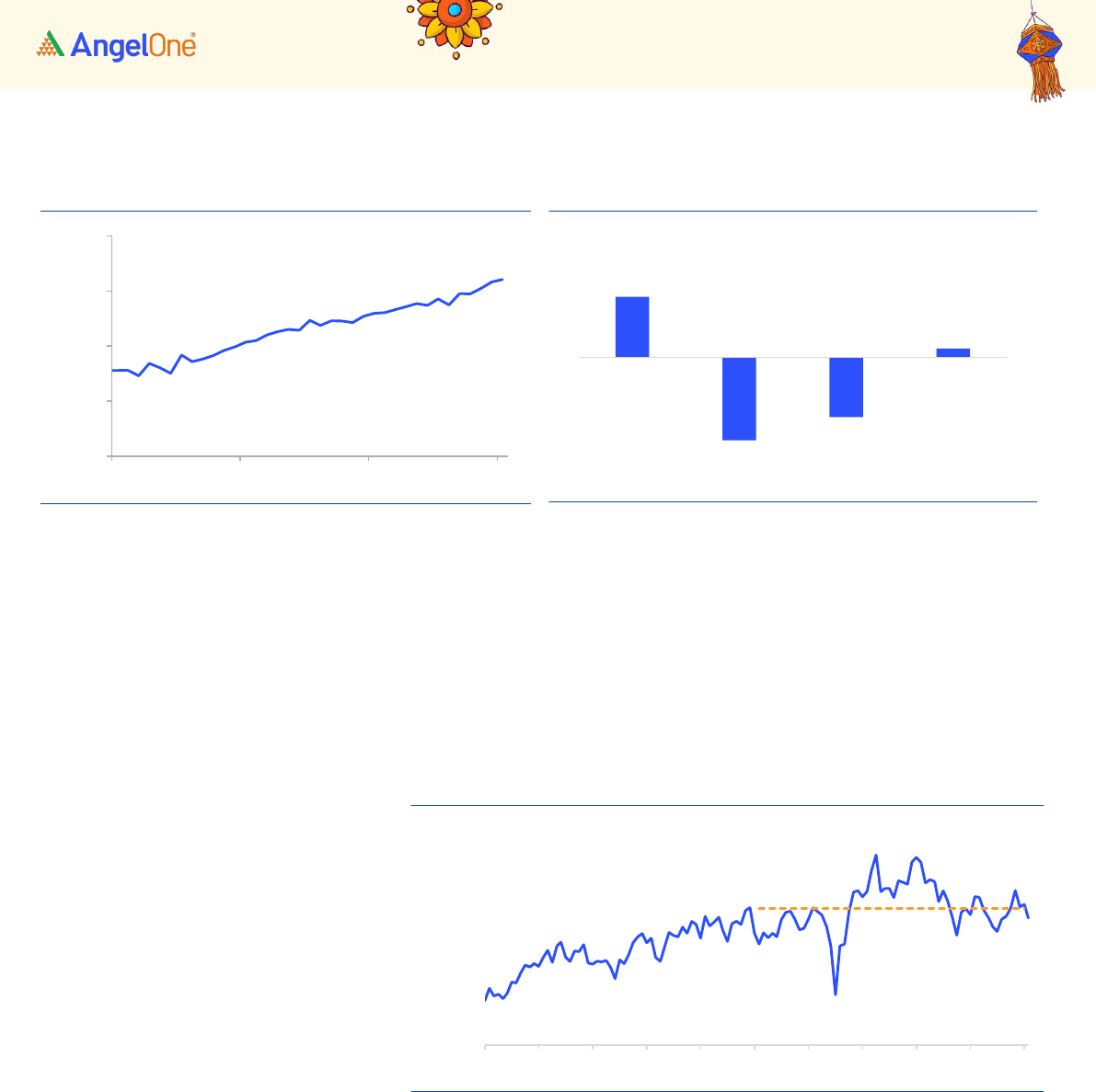

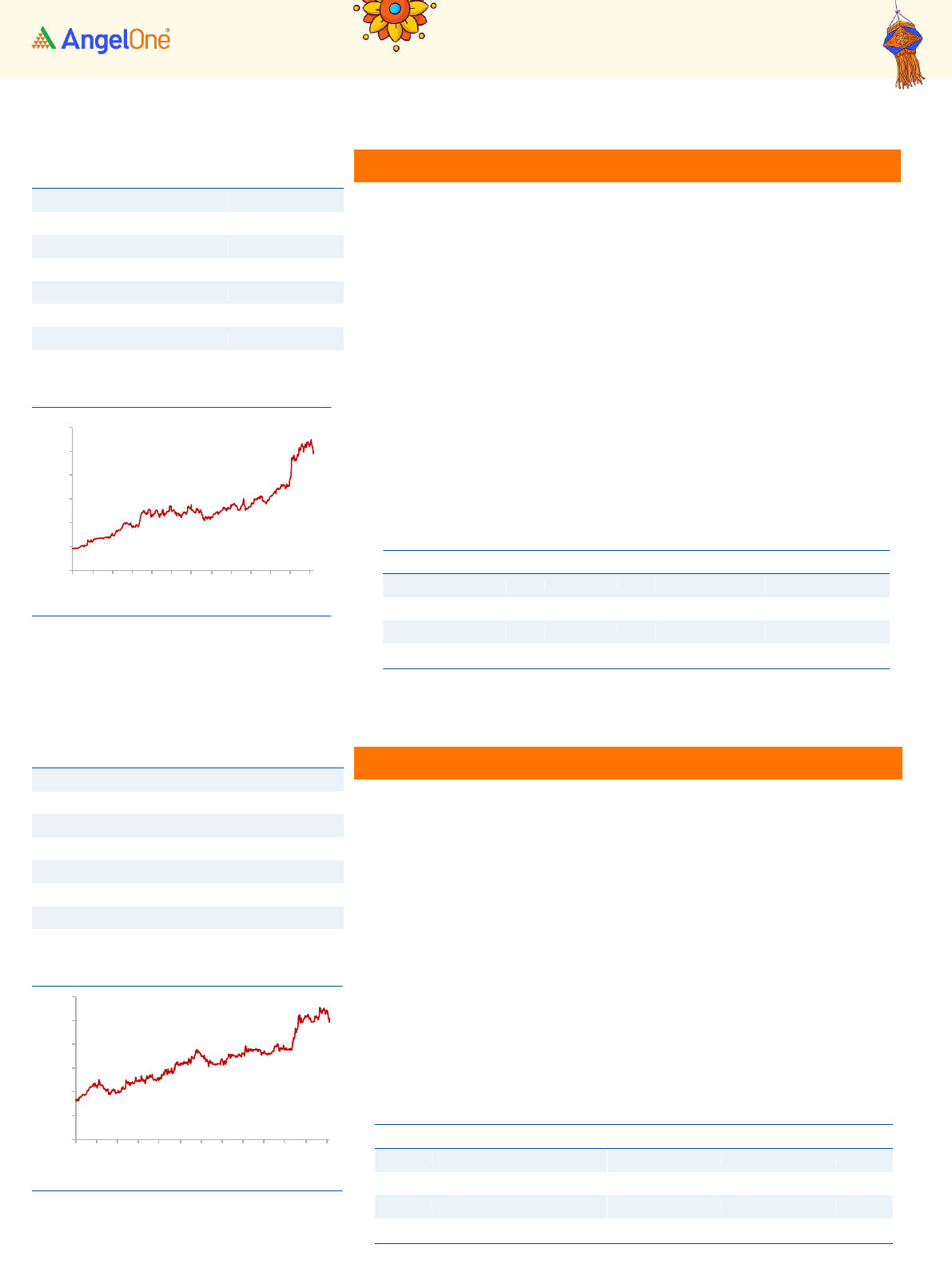

3-Year-Chart

-

1,000

2,000

3,000

4,000

5,000

6,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Stock Info

CMP

996

TP

1260

Upside

27%

Sector

Healthcare

Market Cap (`cr)

20,790

Beta

0.4

52 Week High / Low

1135/705

3-Year-Chart

-

200

400

600

800

1,000

1,200

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(` cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

8,792

882

59

14.5

18.6

28.6

5.3

2.3

FY2022

12,204

909

61

11.7

16.4

40.2

6.6

2.9

FY2023

14,108

1,270

85

14.0

19.2

40.5

7.8

3.0

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

2,583

(14)

(1)

8.1

-1.3

-

8.9

3.4

FY2022

3,701

342

17

18.6

23.0

39.2

9.0

4.3

FY2023

4,525

606

30

23.1

28.4

30.1

8.6

3.6

Source: Company, Angel Research

14

Diwali Picks Report | November 2023

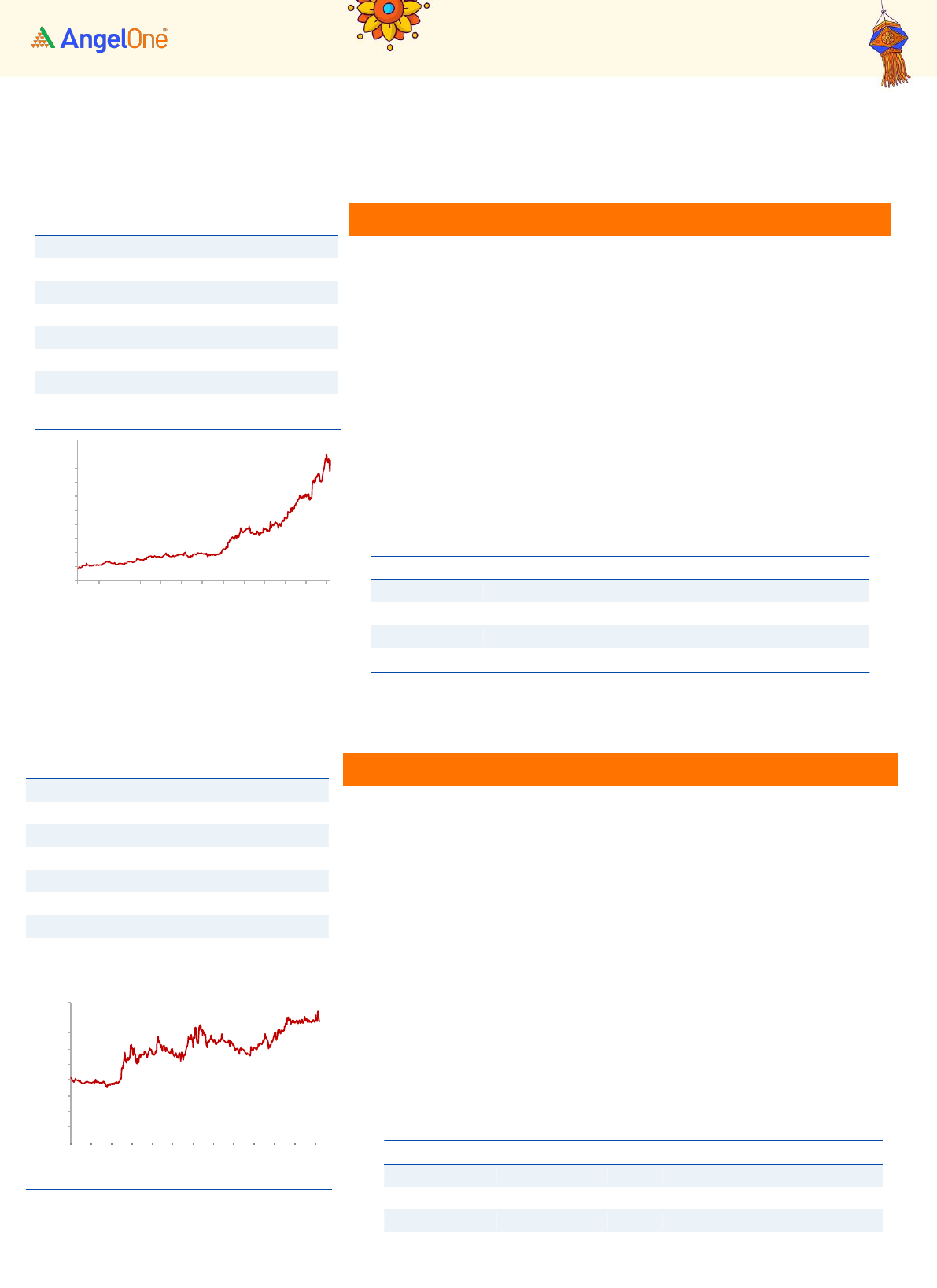

AIA Engineering

AIA Engineering is among the largest manufacturer and supplier of high

chrome wear, corrosion, and abrasion resistant castings. With a strong

international presence, the company generates ~70-80% of its revenue from

exports. It caters to major markets including the UAE, UK, USA, among others.

In Q1FY24, revenue rose by 14.8% on a YoY basis to Rs 1,240 Crores and net

profit rose by 42.9% on a YoY basis to Rs 273 Crores. Growth is supported by

EBITDA margin improvement, favorable product mix, and operational

efficiency

Revenue is likely to be supported by demand in the cement and mining sector.

To capitalize on this increasing demand, the company is undertaking a capex

which will increase its Total Manufacturing Capacity by ~18% from 440,000 TPA

(FY23) to 520,000 TPA (FY25). Additionally, the company is strategically

focusing on value-added products, such as tube mill internals and crusher

parts, which offer higher margins.

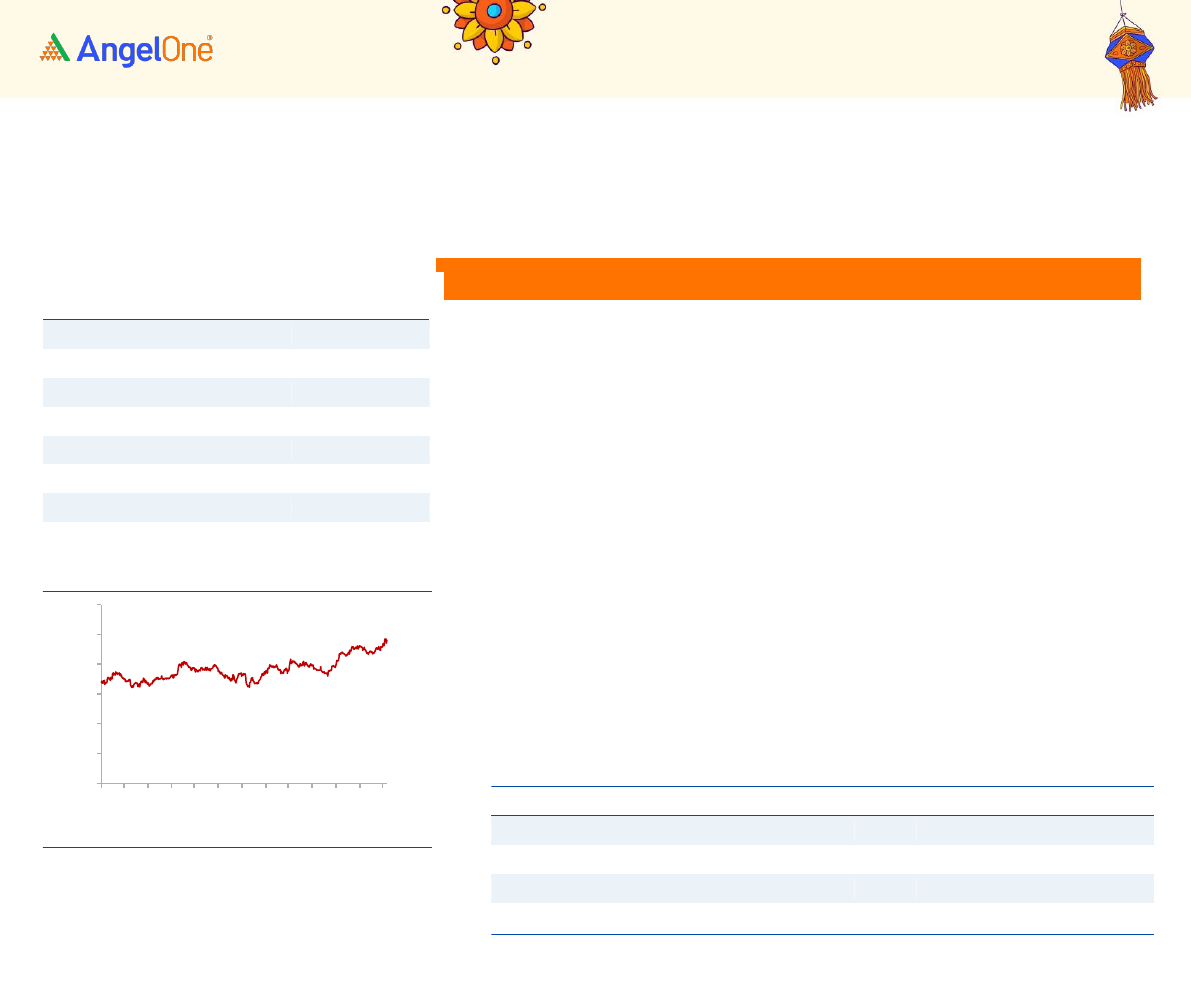

Kirloskar Oil

Kirloskar Oil, a flagship of the Kirloskar Group, is a global leader in generator

sets, specializing in the manufacturing of both air-cooled and water-cooled

engines and diesel generating sets across a wide range of power output from

5kVA – 3000 kVA. Serving diverse sectors like power, agriculture, and various

industrial applications, the company has notable global presence with strong

distribution networks in the Middle East and Africa. They have recently

forayed into the NBFC business.

In Q1FY24, revenue rose by 29.5% on a YoY basis to Rs 1,543 Crores and net

profit rose by 53.7% on a YoY basis to Rs 126 Crores

The surge in power generation sector coupled with growth in roads and the

real estate sector will drive demand for diesel gensets. Increased electricity

access in rural areas will boost demand for electric pumps. The Company is

strategically positioned to capitalize on this. Industrial sales will be driven by

railways, metro projects, roads, etc. Overall, the company is well positioned

to benefit from sector tailwinds such as PLI schemes, government

infrastructure spending, and addressing power deficit.

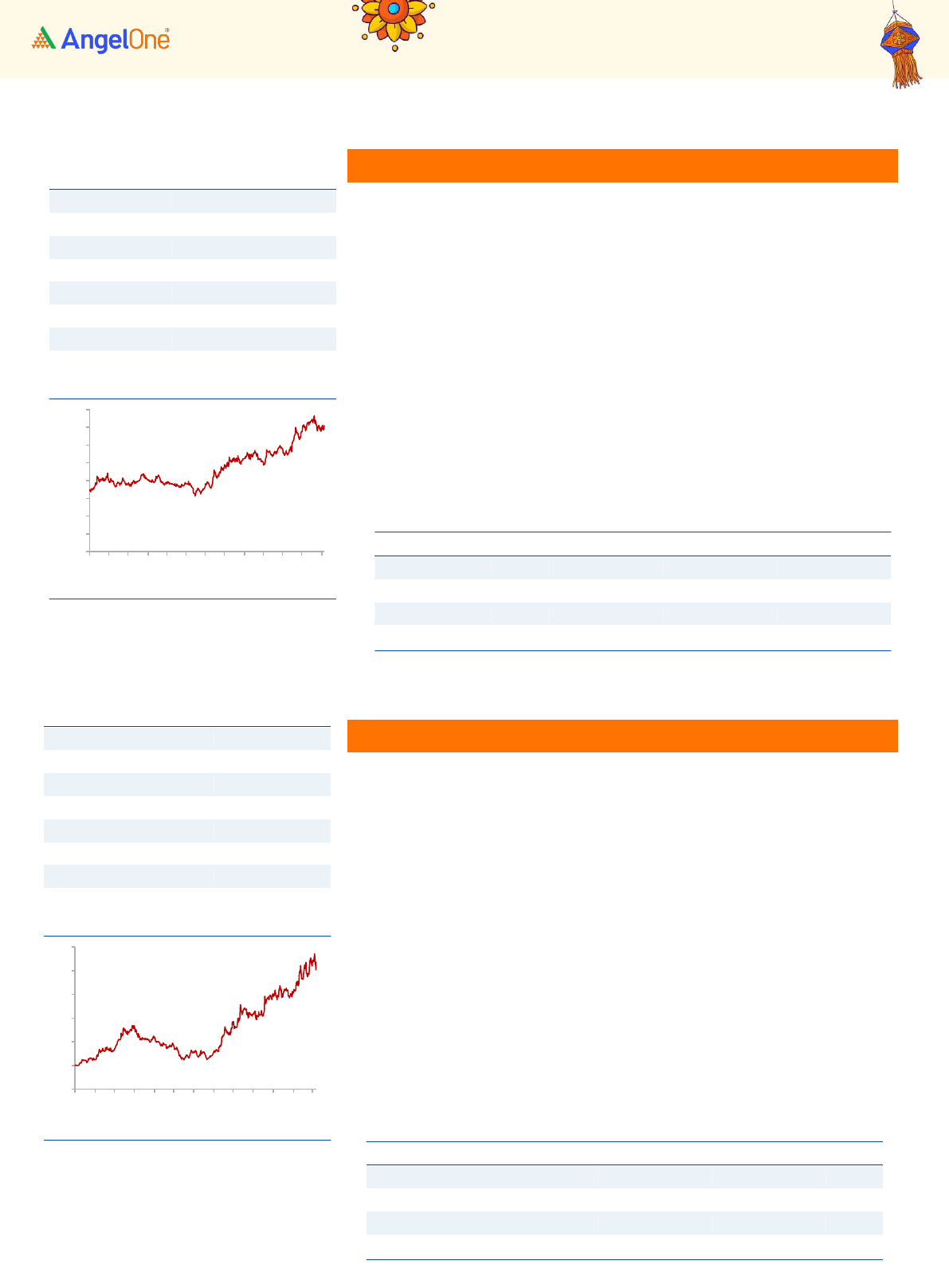

Stock Info

CMP

3513

TP

4230

Upside

20%

Sector

Capital Goods

Market Cap (`cr)

33,327

Beta

0.4

52 Week High / Low

3825/2385

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Stock Info

CMP

543

TP

650

Upside

20%

Sector

Capital Goods

Market Cap (`cr)

7,758

Beta

1.0

52 Week High / Low

577/257

3-Year-Chart

-

100

200

300

400

500

600

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

2,881

566

60

28.9

13.3

32.2

4.3

6.5

FY2022

3,567

620

66

24.7

13.0

34.5

4.5

4.2

FY2023

4,909

1,056

112

30.1

18.6

27.3

5.1

5.5

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

3,296

195

13

12.3

10.1

16.7

1.8

1.3

FY2022

4,022

175

12

10.9

8.4

12.8

1.1

1.2

FY2023

5,024

332

23

15.2

14.4

17.7

2.6

1.7

Source: Company, Angel Research

15

Diwali Picks Report | November 2023

Ramkrishna Forgings

RK Forging is the second largest forging player in India and is primarily engaged

in the manufacturing and sale of forged components of automobiles, railway

wagons & coaches, and engineering parts. The company derives ~80% of its

revenue from the Automobile industry.

In Q2FY24, revenue rose by 19.1% on a YoY basis to Rs 981 Crores and net profit

rose 22.4% on a YoY basis to Rs 82 Crores.

The company is expected to benefit from rebound in the Indian automotive cycle

as well as the tailwind from infrastructure capex driven by government

initiatives like Make in India, PLI, development of industrial corridors.

Furthermore, strategic inorganic acquisitions for forward integration and

product diversification are expected to unlock substantial growth potential in

both the domestic and export markets.

Wendt India

Wendt India is JV between 3M India and Carborundum Universal, and is a

leading manufacturer of Super Abrasives, Machining Tools, and Precision

Components. It is a preferred supplier for multiple automotive, auto

components, engineering, aerospace, and defense & ceramics customers.

In Q2FY24, revenue and PAT declined by 2.7% and 10.0% on a YoY basis,

respectively due to lower offtake from some customers due to a slowdown in

the USA, Taiwan, Russia, and Europe.

The Company is actively working on de-risking its Precision component

business to reduce dependence on the Auto Industry. This is being achieved

by exploring new markets in diverse industries like aerospace, Surgical

blades, refrigerators, air conditioning parts, etc. The launch of new products

is likely to support growth and profitability.

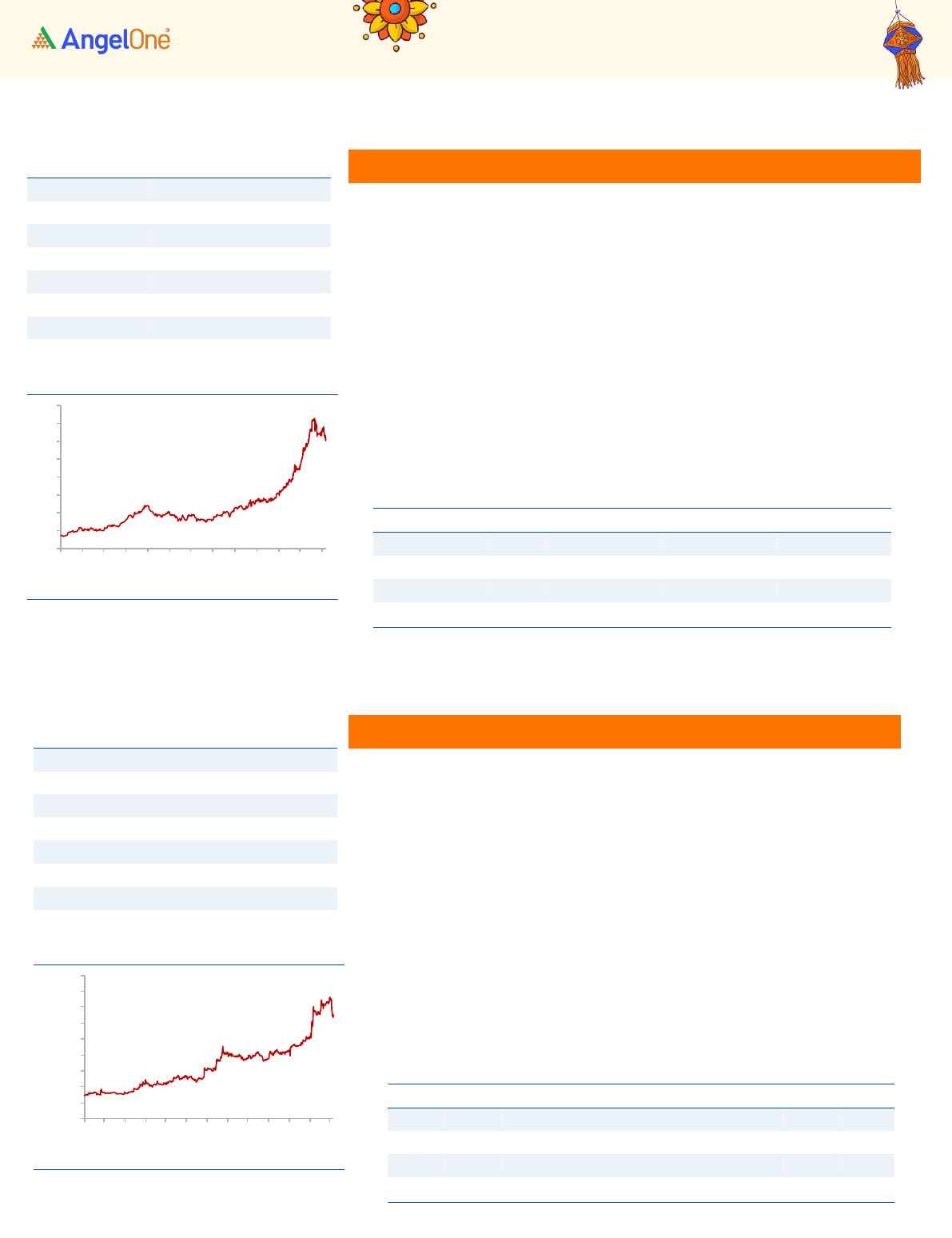

Stock Info

CMP

641

TP

780

Upside

22%

Sector

Capital Goods

Market Cap (`cr)

9,872

Beta

1.6

52 Week High / Low

753/216

3-Year-Chart

-

100

200

300

400

500

600

700

800

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Stock Info

CMP

12,320

TP

15,480

Upside

26%

Sector

Capital Goods

Market Cap (`cr)

2,607

Beta

0.8

52 Week High / Low

15535/7050

3-Year-Chart

-

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

1,289

21

6

17.8

2.3

100.6

2.4

2.5

FY2022

2,320

198

12

22.4

18.4

13.5

2.5

1.6

FY2023

3,193

248

16

21.9

18.8

25.1

4.7

1.8

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

137

13

64

19.5

8.9

53.4

4.8

4.5

FY2022

179

27

135

25.8

16.7

50.8

8.5

5.5

FY2023

210

40

200

29.3

21.2

46.1

9.8

8.0

Source: Company, Angel Research

16

Diwali Picks Report | November 2023

LTIMindtree

LTIMindtree is an Indian multinational information technology services and

consulting company. The company provides a wide range of IT services such

as application development maintenance (ADM), enterprise solutions,

infrastructure management services, testing, analytics & artificial

intelligence. The Company derives a majority of its revenue from BFSI and

Media & Entertainment industry. The company has a presence in 30+

countries but derives 73.4% of revenue from North America (Q2FY24).

In Q2FY24, revenue increased by 8.2% on a YoY basis to Rs 8,905 Crores, but

profit fell 2.3%YoY to 1162 Cr on account of wage hikes. However, the

company has delivered better than most of its larger Indian IT peers.

LTIMindtree is well positioned to deliver growth in the long term, given its

multiple long-term contracts with the world’s leading brands, robust deal

wins, and superior execution capabilities. Management is guided for high

single-digit to low double-digit growth in FY24 with margin expansion.

However, there is growing concern regarding the economic outlook of major

economies, which presents a potential risk to the company’s growth.

Blue Star

Blue Star is India’s leading air conditioning and commercial refrigeration

company. The Company manufactures air purifiers, air coolers, water

purifiers, cold storage, and specialty products. The Company has three main

segments, a) Electro-Mechanical Projects (EMP) & Commercial air

conditioning (50.3% in FY23), c) Unitary products (45.5% in FY23), and d)

Professional Electronics and Industrial Systems (4.2% in FY23).

In Q2FY24, revenue increased by 19.5% on a YoY basis to Rs 1,890 Crores and

net profit rose 65.1% YoY to Rs 71 Crores. Revenue growth is driven by growth

in EMP business

The air conditioner penetration is less than 10% in India and the company

expects the industry to grow at a CAGR of 20% over the next 2-3 years.

Intense summer conditions, reduction in electricity consumption, and rising

affordability will result in strong demand for air conditioners.

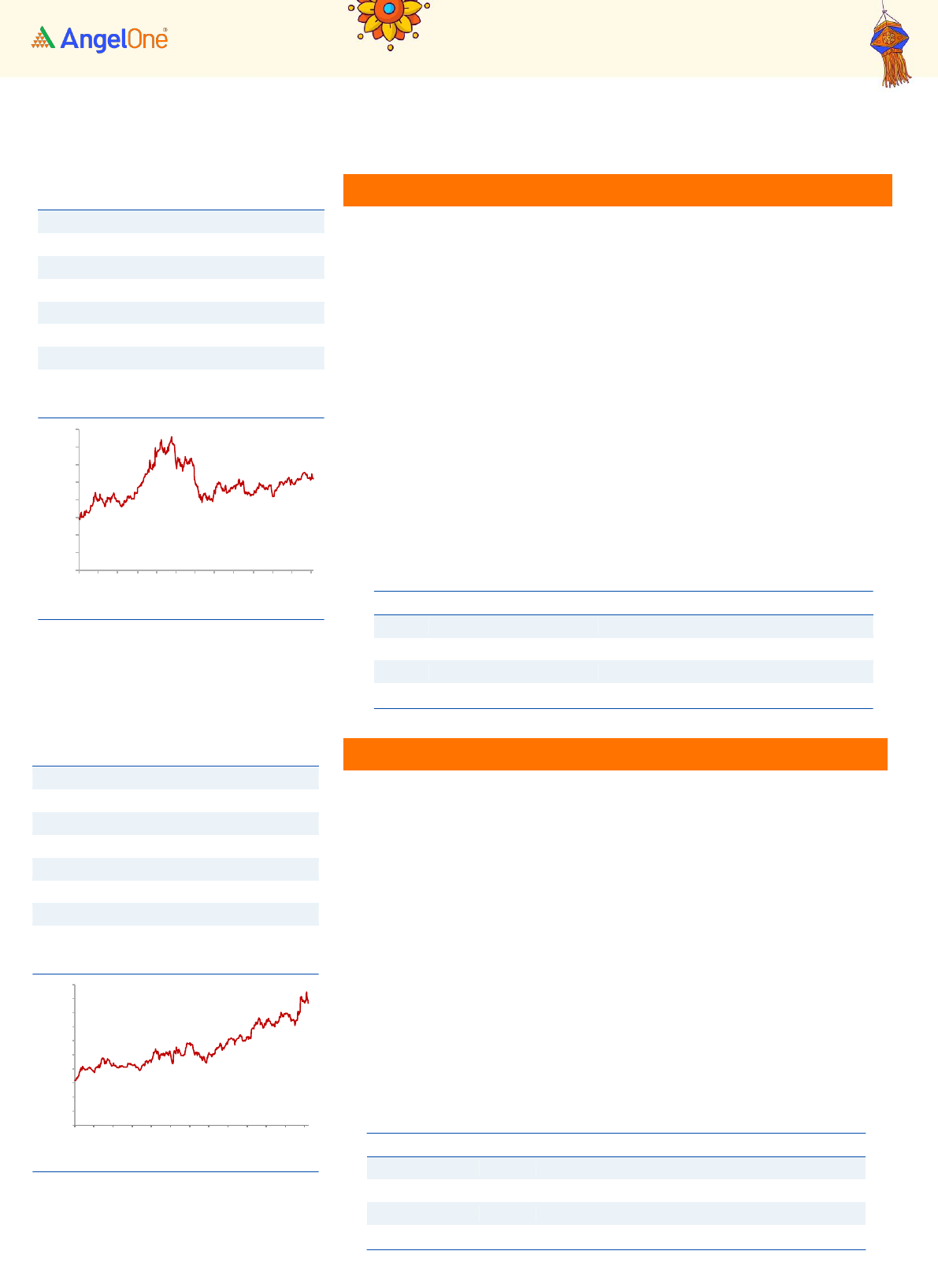

Stock Info

CMP

985

TP

1348

Upside

37%

Sector

IT

Market Cap (₹cr)

266,414

Beta

0.8

52 Week High / Low

1377/944

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

Jul-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Source: Company, Angel Research

Stock Info

CMP

878

TP

1130

Upside

29%

Sector

Consumer Durables

Market Cap (`cr)

16,628

Beta

0.3

52 Week High / Low

950/553

3-Year-Chart

-

100

200

300

400

500

600

700

800

900

1,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Stock Info

CMP

5061

TP

6370

Upside

26%

Sector

Information Technology

Market Cap (`cr)

152,977

Beta

1.2

52 Week High / Low

5590/4120

3-Year-Chart

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

12,370

1,936

111

24.2

26.5

35.6

9.4

5.6

FY2022

26,109

3,948

133

23.0

27.6

32.5

9.6

4.0

FY2023

33,183

4,408

149

20.1

26.6

33.5

8.9

4.2

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

4,264

100

10

7.1

11.3

79.1

9.0

2.2

FY2022

6,064

168

17

6.3

16.5

58.8

9.7

1.7

FY2023

7,977

400

42

8.7

30.1

50.2

10.5

1.7

Source: Company, Angel Research

17

Diwali Picks Report | November 2023

Cera Sanitaryware

Cera Sanitaryware Ltd is engaged in the business of manufacturing and selling

of diverse range of building products. This includes sanitaryware, faucetware,

bath accessories, ceramic tiles & modular kitchens in India. The company has a

strong brand presence in the Indian market and exports its products to over 50

countries. Its product portfolio addresses a wide spectrum of price points,

ranging from mass-market to premium & luxury segments.

In Q1FY24, revenue increased by 7.9% on a YoY basis to Rs 429 Crores and net

profit rose 42.5% YoY to Rs 57 Crores. Margins have improved on the back of

easing prices of raw materials

We expect demand to remain robust from home upgradation and replacement

markets backed by increased home sales. Also, brownfield expansion of the

faucetware facility commenced production in Sep’23, positioning it as a

significant driver of growth. Further, management has stated their guidance of

20% revenue growth in FY24.

Persistent system

Persistent System provides software engineering and strategy services to help

companies implement and modernize their businesses. It has its own software

and frameworks with pre-built integration and acceleration. It also has a

partnership with providers such as Salesforce and AWS.

In Q2FY24, revenue increased by 17.7% on a YoY basis to Rs 2,412 Crores and

net profit increased by 19.6% on a YoY basis to Rs 263 Crores. The company has

delivered strong performance in an environment where execution remains a

challenge. Strong deal wins and a healthy pipeline is the key support against

macro headwinds.

The company is expected to show strong broad-based growth across verticals

backed by strong deal pipeline and better client engagements. Further,

management has guided margin improvements in coming quarters, which is

likely to sustain the growth trajectory.

Stock Info

CMP

6,612

TP

7,700

Upside

25%

Sector

Information Technology

Market Cap (`cr)

46,812

Beta

1.3

52 Week High / Low

6144/3611

3-Year-Chart

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Stock Info

CMP

8,481

TP

10,740

Upside

27%

Sector

Consumer Durables

Market Cap (`cr)

11,084

Beta

0.2

52 Week High / Low

9782/4950

3-Year-Chart

-

2,000

4,000

6,000

8,000

10,000

12,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

1,224

101

77

15.0

11.3

55.8

6.5

4.2

FY2022

1,446

151

116

17.1

14.9

35.3

5.4

4.5

FY2023

1,804

209

161

17.9

17.9

45.8

8.3

4.6

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

4,188

451

59

18.9

16.1

43.2

7.0

3.4

FY2022

5,711

690

90

19.3

20.5

43.4

8.5

6.3

FY2023

8,351

921

121

18.7

23.2

41.6

9.9

4.2

Source: Company, Angel Research

18

Diwali Picks Report | November 2023

Godfrey Phillips

Godfrey Phillips India Limited (GPIL) is a tobacco company headquartered in

Kolkata, India. GPIL's business is divided into two segments: tobacco (90% in

Q1FY24) and non-tobacco business (10% in Q1FY24). It also has an exclusive

sourcing and supply agreement with Philip Morris International to

manufacture and distribute the renowned Marlboro brand in India.

In Q1 FY24, revenue increased by 26.4% on a YoY basis to Rs 1,046 Crores and

net profit increased by 78.8% YoY to Rs 254 Crores. Topline growth was

supported by a significant increase in exports of unmanufactured tobacco.

Future growth for the company is likely to be driven by targeting new

cigarette markets as they are currently concentrated in Norther & Western

India and focusing on international business by sale of unmanufactured

tobacco. Further, Non-tobacco segment includes 146 convenience stores of

24Seven.

H.G. Infra Engineering

H.G. Infra Engineering is an infrastructure company that provides EPC

(Engineering, Procurement, and Construction) services for road and highway

projects in India. Its project includes the maintenance of roads, bridges,

flyovers, and other infrastructure contract contracts. The company primarily

generates its revenue from road and highway projects from government and

private undertakings.

In Q1FY24, its revenue increased by 22.2% on a YoY basis to Rs 1,351 Crores

and net profit increased by 37.4% on a YoY basis to Rs 150 Crores. The growth

is on the back of strong order book which stands at ~2.5x Order book to bill

ratio

In the Union Budget 2023-24 allocated a substantial increase in Capex for

various sectors, including a 25% boost for the Road, 27% for Jal Jeevna

Mission, and 49% for railways. This has opened up significant opportunities

for companies like HG Infra. Leveraging this, the company is diversifying

beyond road projects to seize these massive opportunities. With a healthy

order book stands healthy of Rs 11,675 Cr (as of Jun’23), comprising 53% from

the EPC projects and 47% from the HAM projects, coupled with a robust

balance sheet with impressive return ratios, HG Infra is well positioned to

maintain its growth momentum.

Stock Info

CMP

2,261

TP

2,700

Upside

19%

Sector

FMCG

Market Cap (`cr)

11,229

Beta

1.4

52 Week High / Low

2357/1462

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Stock Info

CMP

894

TP

1,190

Upside

33%

Sector

Construction

Market Cap (`cr)

5,882

Beta

1.0

52 Week High / Low

1017/532

3-Year-Chart

-

200

400

600

800

1,000

1,200

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

2,543

377

72

25.9

14.6

14.6

2.0

2.0

FY2022

2,706

438

84

27.6

15.0

13.7

2.1

2.1

FY2023

3,589

690

133

29.4

19.5

13.1

2.6

2.7

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

2,610

237

36

18.8

22.3

10.8

2.4

1.1

FY2022

3,751

380

58

19.1

26.5

9.8

2.6

1.4

FY2023

4,622

493

76

19.8

25.7

12.0

3.1

1.5

Source: Company, Angel Research

19

Diwali Picks Report | November 2023

Safari Inds.

SIL is a manufacturer and marketer of luggage and travel accessories in India.

It has a wide range of products, including hard luggage, soft luggage,

backpacks, and travel accessories.

In Q1FY24, the company reported revenue rose by 45.6% on a YoY basis to Rs

427 Crores and net profit increased by 85.2% on a YoY basis to Rs 50 Crores.

The company has consistently delivered strong performance on the back of

gaining market share.

Safari Industries is poised for a strong performance due to the increasing

advantages of domestic manufacturing, a dip in raw material costs, and a

more stable ocean freight situation. Additionally, their plans to expand

manufacturing capacity and venture into the premium segment in the near

future are anticipated to bolster profitability in the short to long term.

CRISIL

CRISIL, a subsidiary of S&P Global, specializes in offering ratings, research, as

well as risk and policy advisory services to its clients. The company is the

largest credit rating agency in India. Its research business is the highest

contributor to its overall revenue. Moreover, its affiliation with S&P Global

facilitates the integration of local and global perspectives in shaping CRISIL’s

strategy and governance systems.

In Q2CY24, its revenue increased by 15.3% on a YoY basis to Rs 771 Crores and

net profit increased by 10.0% YoY to Rs 151 Crores. Favorable domestic macros

like improving banking credit and corporate bond issuances have resulted in

strong growth.

Favorable domestic demand, an upswing in bond market activities, and the

company's global scalability capabilities all augur well for CRISIL's revenue

growth. With its superior brand, diversified revenue streams, robust

parentage, and impressive return ratios, CRISIL has historically commanded a

premium over its peers, and we anticipate this trend to continue in the future.

Stock Info

CMP

4,140

TP

5,330

Upside

29%

Sector

Consumer Durables

Market Cap (`cr)

10,140

Beta

0.7

52 Week High / Low

4535/1576

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Stock Info

CMP

4,105

TP

4,850

Upside

18%

Sector

Financial Services

Market Cap (`cr)

28,479

Beta

0.3

52 Week High / Low

4283/2712

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

FY2021

328

(21)

(9)

-0.8

-7.5

-

4.9

4.1

FY2022

705

22

10

7.6

7.4

69.4

6.8

3.2

FY2023

1,212

125

53

17.0

29.4

51.7

15.2

4.1

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

CY2020

1,982

355

49

30.0

27.0

39.9

10.8

6.9

CY2021

2,301

466

64

31.9

29.5

48.9

13.4

5.7

CY2022

2,769

564

77

30.8

31.5

43.8

13.8

8.4

Source: Company, Angel Research

20

Diwali Picks Report | November 2023

Nestle India

Nestle India is a subsidiary of Nestle which is a Swiss MNC. The company has

established a market position in most of the product categories it has a

presence in. The major product categories are milk products and nutrition

(40.4% of revenue in CY22), beverages (11.4% of revenue in CY22), prepared

dishes and cooking aids (32.2% of revenue in CY22), and chocolate and

confectionery (16.0% of revenue in CY22).

In Q3CY23, its revenue increased by 9.4% YoY to Rs 5,037 Cr and net profit rose

37.4% YoY to Rs 908 Crores. Nestle was able to expand its gross margins in

diary segment and reckon its strong market leadership in Infant Nutrition.

Nestle continues to benefit from distribution expansion, especially in rural

India. The sustainability of the growth trajectory is expected to be driven by

innovation, as well as implementation of higher capex plans in upcoming years,

coupled with increased investments in media. Additionally, focus on

premiumization will also be a crucial driver of growth and profitability

improvement.

Stock Info

CMP

24,239

TP

28,700

Upside

18%

Sector

FMCG

Market Cap (`cr)

231,956

Beta

0.5

52 Week High / Low

24736/17888

3-Year-Chart

-

5,000

10,000

15,000

20,000

25,000

30,000

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Jan-23

Apr-23

Jul-23

Oct-23

Source: Company, Angel Research

Key Financials

Y/E

Sales

PAT

EPS

OPM

ROE

P/E

P/BV

EV/Sales

March

(₹ cr)

(₹ cr)

(₹)

(%)

(%)

(x)

(x)

(x)

CY2020

13,350

2,082

216

25.1

103.1

74.5

76.9

12.4

CY2021

14,741

2,118

220

22.7

108.8

88.9

81.4

11.0

CY2022

16,897

2,391

248

21.9

97.2

75.3

73.2

10.9

Source: Company, Angel Research

21

Diwali Picks Report | November 2023

Stock Bought in last six Month

Stock Sold in last six months

Stock

Date

Reco

Price

AIA Engineering

26-Oct-23

BUY

3,385

Polycab India

25-Oct-23

BUY

5,080

Narayana Hrudaya

4-Oct-23

BUY

1,108

LTI Mindtree

14-Sep-23

BUY

5,544

Godfrey Phillips

30-Aug-23

BUY

2,164

Wendt India

30-Aug-23

BUY

13,114

Apollo Tyres

17-Aug-23

BUY

393

Akzo Nobel

17-Aug-23

BUY

2,848

Kirloskar Oil

17-Aug-23

BUY

512

Safari Inds.

11-Aug-23

BUY

3,420

P I Industries

9-Aug-23

BUY

3,835

UTI AMC

8-Aug-23

BUY

771

Blue Star

30-Jun-23

BUY

763

eClerx Services

30-Jun-23

BUY

1,711

Ingersoll-Rand

30-Jun-23

BUY

2,860

Cera Sanitary.

28-Jun-23

BUY

7,696

H.G. Infra Engg.

28-Jun-23

BUY

870

Ramkrishna Forg.

28-Jun-23

BUY

468

CRISIL

26-Jun-23

BUY

3,884

KEI Industries

26-Jun-23

BUY

2,242

Persistent Sys

26-Jun-23

BUY

4,958

Astral

23-Jun-23

BUY

1,929

Britannia Inds.

23-Jun-23

BUY

4,956

Tube Investments

23-Jun-23

BUY

3,336

ITC

21-Jun-23

BUY

451

LTIMindtree

21-Jun-23

BUY

4,992

Nestle India

21-Jun-23

BUY

22,850

Source: Company, Angel Research

Stock

Date

Reco

Price

Akzo Nobel

26-Oct-23

EXIT

2,365

Tube Investments

25-Oct-23

EXIT

2,390

P I Industries

4-Oct-23

EXIT

3,414

Astral

14-Sep-23

EXIT

1,900

Apollo Tyres

30-Aug-23

EXIT

390

ITC

30-Aug-23

EXIT

443

KEI Industries

17-Aug-23

EXIT

2,413

Ingersoll-Rand

17-Aug-23

EXIT

3,022

UTI AMC

17-Aug-23

EXIT

760

eClerx Services

17-Aug-23

EXIT

1,702

LTIMindtree

9-Aug-23

EXIT

5,101

Britannia Inds.

8-Aug-23

EXIT

4,606

Amber Enterp.

30-Jun-23

EXIT

2,262

AU Small Finance

28-Jun-23

EXIT

745

HDFC Bank

28-Jun-23

EXIT

1,676

Sona BLW Precis.

28-Jun-23

EXIT

520

Devyani Intl.

26-Jun-23

EXIT

193

HCL Technologies

26-Jun-23

EXIT

1167

Jubilant Ingrev.

26-Jun-23

EXIT

423

Marico

23-Jun-23

EXIT

523

Oberoi Realty

23-Jun-23

EXIT

987

Sobha

23-Jun-23

EXIT

532

Federal Bank

21-Jun-23

EXIT

124

Stove Kraft

21-Jun-23

EXIT

450

Suprajit Engg.

21-Jun-23

EXIT

395

22

Diwali Picks Report | November 2023

DISCLAIMER

We, Angel One Limited (hereinafter referred to as “Angel”) a company duly incorporated under the provisions of the

Companies Act, 1956 with its registered office at 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai –

400093, CIN: (L67120MH1996PLC101709) and duly registered as a member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd

and National Commodity & Derivatives Exchange Ltd.

Angel One limited is a company engaged in diversified financial services business including securities broking, DP services,

distribution of Mutual Fund products. It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164 and also registered with PFRDA as PoP, Registration No.19092018. Angel Group does not have

any joint ventures or associates. Angel One Limited, is the ultimate parent company of the Group. Angel or its associates

has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

AOL was merged with Angel Global Capital Private Limited and subsequently name of Angel Global Capital Private Limited

was changed to Angel Broking Private Limited (AOL) pursuant to scheme of Amalgamation sanctioned by the Hon'ble High

Court of Judicature at Bombay by Orders passed in Company Petition No 710 of 2011 and the approval granted by the

Registrar of Companies. Further, name of Angel Broking Private Limited again got changed to Angel Broking Limited (AOL)

pursuant to fresh certificate of incorporation issued by Registrar of Companies (ROC) dated June 28, 2018. Further name

of Angel Broking name changed to Angel One Ltd pursuant to fresh certificate of incorporation issued by Registrar of

Companies (ROC) dated 23-09-21.

In case of any grievances please write to: support@angelone.in, Compliance Officer Details: Name: Hiren Thakkar, Tel

No. – 08657864228, Email id - compliance@angelone.in.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide

any assurance of returns to investors.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment

in the securities of the companies referred to in this document (including the merits and risks involved), and should consult

their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the

securities of the subject company at the end of the month immediately preceding the date of publication of the research

report. Neither Angel or its associates nor Research Analysts or his relative has any material conflict of interest at the time of

publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the

period preceding twelve months from the date of this report for services in respect of managing or co-managing public

offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a

merger or specific transaction in the normal course of business. Angel or its associates did not receive any compensation or

other benefits from the companies mentioned in the report or third party in connection with the research report. Neither

research entity nor research analyst has been engaged in market making activity for the subject company.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as

such, as this document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not

be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the

information contained in this report.

Angel One Limited does not warrant the accuracy, adequacy or completeness of the service, information and materials and

expressly disclaims liability for errors or omissions in the service, information and materials. While Angel One Limited

endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

23

Diwali Picks Report | November 2023

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information. Angel or its associates or Research Analyst or his relative might have

financial interest in the subject company. Research analyst has not served as an officer, director or employee of the subject

company.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Any

communication sent to clients on phone numbers or e-mail ids registered with the Trading Member is meant for client

consumption and such material should not be redistributed.

Brokerage will not exceed SEBI prescribed limit. Any Information provided by us through any medium based on our research

or that of our affiliates or third parties or other external sources is subject to domestic and international market conditions

and we do not guarantee the availability or otherwise of any securities or other instruments and such Information is merely

an estimation of certain investments, and we have not and shall not be deemed to have assumed any responsibility for any

such Information.

You should seek independent professional advice and/or tax advice regarding the suitability of any investment decision

whether based on any Information provided by us through the Site from inhouse research or third party reports or otherwise.

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not

be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent

24

Diwali Picks Report | November 2023